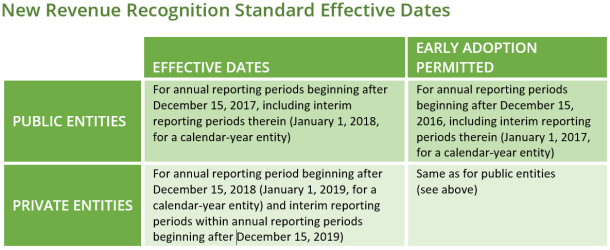

We don’t want to add more to your to do list as things get busy around the holidays, but this is important! By now you’ve heard about the new rules governing revenue recognition for companies that will go into effect on January 1, 2018 for public companies, and January 1, 2019 for private firms. To recap, listen in to our podcast where I speak with Microsoft about the details.

ASC606 Overview

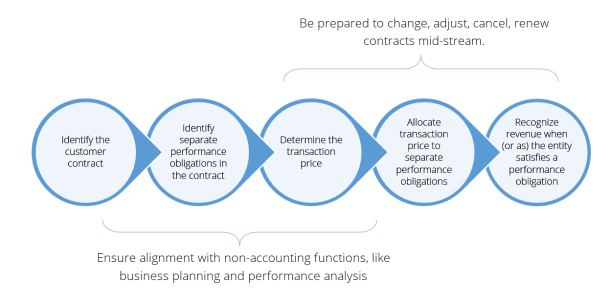

The Accounting Standard Codification 606, or ASC 606, made its debut in May 2014. It is an industry-neutral revenue recognition model designed to increase financial statement comparability among companies and industries. The objective is to decrease complexity involved with the current models for revenue recognition.

As a result, the new unit of account for revenue recognition is the obligation of a good or a service at the time it is delivered.

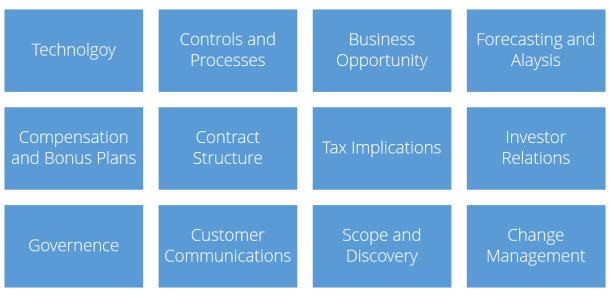

The Financial Accounting Standards Board (FASB), which administers Generally Accepted Accounting Principles in the U.S. (US-GAAP) has issued ASC 606, and the International Accounting Standards Board (IASB), which administers International Financial Reporting Standards (IFRS) used in most other countries, has issued IFRS 15. Both will enforce similar, fundamental changes to the revenue recognition process for any company that depends on complex contracts in their dealings with customers.

How do I know if my company will be impacted by ASC 606 and IFRS 15?

Businesses that have multiple components (e.g., product, services, warranties, etc.) in a single contract are the most impacted. If your firm permits changes to active contracts (e.g., adding a sports package to your cable TV contract), they are impacted. If the timing of when your firm pays commissions differs from when the products and services are delivered, then your firm is impacted. Cellular phone companies, software firms and many other kinds of companies will be impacted – some far more so than others.

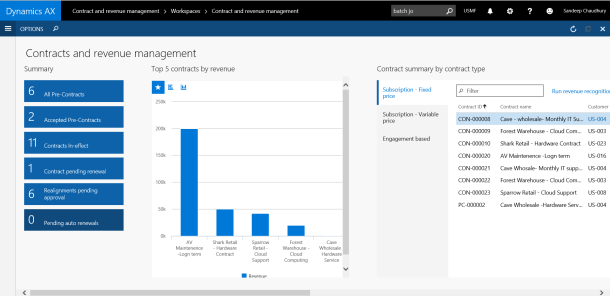

Not Managed by Microsoft Dynamics out of the Box

Microsoft Dynamics does not manage these new standards out of the box. Companies running Dynamics GP, NAV, AX, or 365, must take all of their revenue outside ERP, process these complex calculations to figure out what they can recognize today versus what is deferred, and then bring those back in as manual journal entries. Before you start using Excel for this, consider using AXIO for Enterprise Firms, and Progressus for Small to Medium-sized Firms in addition to Microsoft Dynamics.

We wish you the best of luck with these new standards. Please let us know if you have any questions, and Happy Thanksgiving!

Best regards,

Robbie Morrison

Chief Solution Strategist, SBS Group

About Robbie

Robbie Morrison has spent nearly 20 years helping customers build and deploy elegant technology and business solutions. From start-ups to enterprise-class organizations worldwide, his knowledge of the Microsoft Dynamics ecosystem andproducts helps SBS Group customers maximize ROI on technology investments.

Today, Robbie serves SBS Group customers in his role as Chief Solution Strategist where he provides thought leadership and manages the development of B2B solutions. Robbie received his MBA from the University of Georgia, Terry College of Business.

https://www.linkedin.com/in/robbiemorrison