This is the sixth in a series of six blogs, which attempt to provide airport accounting managers with information on how they can improve their financial management processes. The previous blogs covered the following topics:

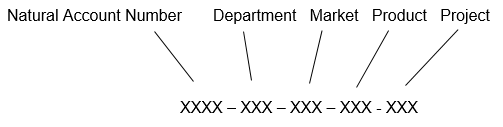

- Blog number 1: the benefits of using a multi-dimensional accounting system like Microsoft Dynamics NAV 2017

- Blog number 2: the key to improving productivity and accuracy of data by integrating your accounting system with other airport systems

- Blog number 3: how to improve your reports by capturing key statistical data and combining this data with your financial data.

- Blog number 4: implement a new data visualization product like Microsoft Power BI

- Blog number 5: Cloud Technology is the Future – Time to Upgrade (Part 1 of 2)

This blog continues the discussion from blog number 5 on cloud computing and describes how airports can take advantage of advances in cloud technology.

In addition, readers are encouraged to read my white paper (Modern Airport, Modern Tools) that covers the same topics in a summarized form.

What about Security? Is my data secure on the Cloud?

Security is a big issue whether you are using on-premises or cloud computing. Many companies think their data is safer on-premises, but the opposite is usually true. There are many issues that impact security, including:

- Firewalls to prevent hackers from getting into you network

- Data backups, including storing some backups off site

- Disaster recovery and business continuity

- What happens if your IT server room catches fire and burns to the ground? How do you recover your data even if you have an offsite backup? You would need another server to restore your data onto and bringing up a new server can take time.

- Anti-virus protection

- Manage and control user access and identity

- Comprehensive identity management is the linchpin of any secure system. You must ensure that only authorized users can access your environment, data, and applications.

- Encryption of data as it travels between devices and your server

- Protection against malware and phishing emails

The chances are that your local IT services do not offer the same security as a multi-million dollar data center, let alone the billion dollar data centers operated by Microsoft.

My favorite analogy to the question of whether your data is safer on-premises or on the Cloud is whether your money is safer in the bank (Cloud) or under your mattress (on-premises).

The Future of Accounting Software…

Microsoft launched a new cloud service in late 2016 called Dynamics 365. I decided to include some information on this new service in this blog post since it is a great example of cloud computing and represents the future of accounting software. If you haven’t already heard about this software as a service, read on….

There are two flavors to this service, Dynamics Enterprise and Dynamics Business. The Enterprise version is intended for larger companies and is based off Microsoft Dynamics AX 7. The Business version is based on Microsoft Dynamics NAV and is intended for smaller businesses with up to 250 employees. Dynamics 365 adds accounting software to other services that are already offered by Microsoft such as Office 365 or new services that are being created such as sales and marketing applications. The Business edition would be suitable for most airports.

Microsoft Dynamics 365 is the next generation of intelligent business applications in the Cloud. Microsoft Dynamics 365 for Financials is the accounting application within the Business edition and is priced at around $40 per user per month, making it very competitive and compelling for many airports.

Dynamics 365 for Financials includes the following:

- Workflow Management

- Financial Management

- Purchasing

- Sales

- Inventory Management

- Project Management

- Requisitions and Quotes

- Timesheets

- Personal Information (HR)

The menus are very simple and the system is designed to be easy to install so that you can get up and running very quickly.

Dynamics 365 is integrated with Power BI, which was discussed in a previous blog, and can be accessed from a laptop, tablet or smart phone.

The system also integrates with Office 365, so that you can create purchase orders within your email system and send them to suppliers – this is extremely cool! If you would like to see this, contact me.

Microsoft is updating the software every month so users are constantly using the latest version of the software. This software is only available on the cloud. We have developed an airport version of this product – contact me for more details.

What are the Economics of Cloud Computing?

In order to decide between a Cloud or on-premises solution, I recommend you take a look at the cost of the two different models. When I prepare a quote for a customer, I usually do this for them and look at the total cost of ownership over a period of 5 years. Why 5 years? Because some of the costs are monthly or annual costs (monthly subscription fees or annual maintenance costs) and some are up-front initial costs (consulting fees for implementation). Once you decide to implement a new system, it is going to last you for at least 5 years, if not longer. Most companies stick with their system, good or bad, for a number of years since the cost and disruption of making a change can be significant.

Let’s take a look at an example. The following table shows the cost of an on-premise system compared to a PaaS and a SaaS Cloud service. These numbers are made up and there may be other costs that should be included in a real cost-benefit analysis, but this example illustrates how you could compare the different solutions. The big difference between an on-premises and cloud solution is the cost of local IT personnel and other IT costs relating to an on-premises system such as the cost of the servers, disk drives, data center costs and other hardware and software costs. If you outsource your system to the Cloud, these costs will mostly go away since you could re-deploy these resources or eliminate them.

In a SaaS solution, you will pay for the software on a subscription basis, which means you will not need to pay for annual maintenance of the software and you won’t have to pay for the up-front purchase cost of the software.

The cost of the PaaS and SaaS models needs to be looked at carefully. It may be less expensive to purchase the software and have it installed on a cloud server rather than pay for the monthly subscription for the software over the next 5 years. However, if you purchase the software, you will be responsible for any upgrades.

Ask your vendor to help you with this cost analysis.

Take Action…..

There are many advantages to implementing a cloud solution, and you could reduce the cost of your system while improving the performance, services offered and security of the system. Contact me if you need help with understanding the benefits of cloud computing, or help with any of the other topics covered in this series of blogs.

Paul Fernandez B.Sc., ACMA, CMA

SBS Group Pacific Canada

About Paul

Paul Fernandez is the general manager of SBS Pacific Canada, which is part of the SBS Group. He has worked as a professional accountant in industry for 25 years in various senior financial positions. He founded his consulting practise 15 years ago and has worked as a consultant implementing accounting systems at many companies, drawing on his own experience to advise clients on the design of their chart of accounts and multi-dimensional reporting structures. Contact Paul at pfernandez@sbsgroup.ca.